Latest Gear Live Videos

Monday October 13, 2008 11:20 am

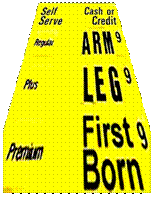

Pain at the Gas Pump

This issue was displaced somewhat by the current economic news, but it is still near and dear to our hearts because we feel it everyday! What’s behind it? If you’re tuning into the cable news channels you’ve probably heard that it’s greedy oil companies, speculators (an upcoming topic), increased demand in India and China, or because we restrict drilling. Well, which is it?

As much as I hate to ruin a good myth, and this one is a gem, it’s none of the above. Going back to my column on the Federal Reserve, we see that the FED lowered interest rates, and by keeping them there, money poured into the economy. Again, what happens when there are more dollars competing for the same number of (or, close to it) goods and services? Yep, prices rise. Gas prices have risen drastically, because oil prices have risen drastically, because the Federal Reserve has increased the money supply drastically

Well, you may be saying, what about the recent decline in prices? The market was adjusting to the increased money in circulation and anticipated this would continue. When the flow of money into the economy ceased, the market adjusted to this and prices stabilized. Oil and gold prices that were overvalued receded, and the undervalued dollar recovered slightly. Monetary inflation always causes distortions in the marketplace and it takes a little time for the adjustments to take place.

The increased demand in developing countries combined with restrictions on drilling also have an impact on prices, but it pales in comparison to the effects of monetary inflation. If that isn’t convincing enough, look at gold, which has effectively doubled since the end of 2003. If you were paid in gold and used it for all purchasing, you;‘d be shaking your head and wondering what all of the fuss was about. To you, prices would’ve remained relatively stable. Is this some trick? No, but it does illustrate how monetary inflation erodes the value of the dollar.

Now the FED is at it again. The flood gates are wide open and new money is pouring into the economy again. This is a massive infusion of money that will eventually work its way through the economy once again, and when it does, what do you think you’ll be paying at the pump then? Did anyone bother to inform you that you would be paying for this bailout at the pump, and everywhere else you spend money regularly? Well, they’re rather busy right now, I’m sure they’ll let us all know as soon as they’ve finished saving us. Wall Street is Main Street, as they keep telling us. Well, I bet Wall Street can afford those higher gas prices, can you?

- Related Tags:

- big oil, economy, federal reserve, gas prices, gold, monetary inflation, money, us economy

Advertisement

Advertisement

Advertisement

© Gear Live Media, LLC. 2007 – User-posted content, unless source is quoted, is licensed under a Creative Commons Public Domain License. Gear Live graphics, logos, designs, page headers, button icons, videos, articles, blogs, forums, scripts and other service names are the trademarks of Gear Live Inc.

Comments: